If you request cash back when making a purchase in a store you may be charged a fee by the merchant processing the transaction. Partnership or S Corporation.

Free Prop Insp Formulas And Measurements Exterior Form Real Estate Forms Printables Word Template

Exclusion of interest from Series EE and I US.

. A self-employed borrowers share of Partnership or S Corporation earnings can only be considered if the lender obtains documentation such as Schedule K-1 verifying that the income was actually distributed to the borrower or the business has adequate liquidity to support the withdrawal of earnings. Interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise be verified by an independent and knowable source. Nontaxable amount of the value of Olympic or Paralympic medals and USOC prize money.

Tax-Exempt Interest Income. In addition to providing information on funding. Student loan interest deduction.

Distribution of income from other partnerships and share of net income from trusts. Technical Termination of a Partnership For taxable years beginning on or after January 1 2019 California conforms to the TCJA repeal of the termination of a partnership by the sale or exchange of 50 percent or more of the total interest in a partnership within a 12 month period. Learn if your business qualifies for the QBI deduction of up to 20.

The amount of the gain to be included in New York source income is determined in a manner consistent with the applicable. See the Student Loan Interest Deduction WorksheetLine 20 later. Form 1040 - Individual Income Tax Return Yr.

Option A involves completing Form 8829 by calculating the total area of your home and getting a percentage for your home businessInclude the total allowable expenses resulting from those calculations on line 30 of Schedule C. Is subject to the provisions of Internal Revenue Code IRC section 1060 and occurred on or after April 10 2017. See the instructions for Schedule 1 line 8 later.

The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities. Option B is a simplified calculation. Any distribution remaining after applying the two steps above is treated as gain from the sale or exchange of property.

See Internal Revenue Code Section 731 for. 5 per square foot of home business space up to 300 square feet for a maximum 1500 deduction. Distribution of foreign income.

Applicants must be 18 years of age in the state in which they reside 19 in Nebraska and Alabama 21 in Puerto Rico. Form 6 Ordering Other Years Income Tax Forms Select Year2020 Income Tax Forms2019 Income Tax Forms2018 Income Tax Forms2017 Income Tax Forms2016 Income Tax Forms2015 Income Tax Forms2014 Income Tax Forms2013 Income Tax Forms2012 Income Tax Forms2011 Income Tax Forms2010 Income Tax Forms Numeric Listing of All Current Nebraska Tax Forms. Savings Bonds issued after 1989.

You want to require that anyone who inherits interest by death or divorce in the business must sell their portion to the company. And The K-1 reflects a documented stable history of receiving cash distributions of income consistent with the level of business income used. Wages salaries considered elsewhere - - 3.

01 During the entitys tax year did the entity own any interest in another partnership or in any foreign entity that was disregarded as an entity separate from its owner under federal regulations Sections 3017701-2 and 3017701-3. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Also interest paid by an insurer on default by the state or political subdivision may be tax exempt.

HOME Program Tribal Listening Session PowerPoint Presentation PDF The Department of Housing and Community Development HCD hosted a Listening Session on January 13 2021 for tribal governments that may be interested in applying for HOME Investment Partnership Program HOME funding. The sale or transfer of a partnership interest where the sale or transfer. Interest on a state or local government obligation may be tax exempt even if the obligation is not a bond.

For partners distributions in excess of basis also results in gain. 731a1 Any gain recognized is considered gain from the sale or exchange of the partnership interest. The borrower can document ownership share for example the Schedule K-1.

For example interest on a debt evidenced only by an ordinary written agreement of purchase and sale may be tax exempt. A self-employed borrowers share of Partnership or S Corporation earnings may be considered provided that. If you do not have a Buy-Sell agreement in place under any of the preceding circumstances then your business could be subject to a partition by sale.

Net small business income.

Fresh Non Profit Balance Sheet Template Business Plan Template Free Statement Template Personal Financial Statement

Download New Sole Trader Business Plan Template Can Save At New Sole Trader Business Plan Template Pdf Business Proposal Template Small Business Plan Template

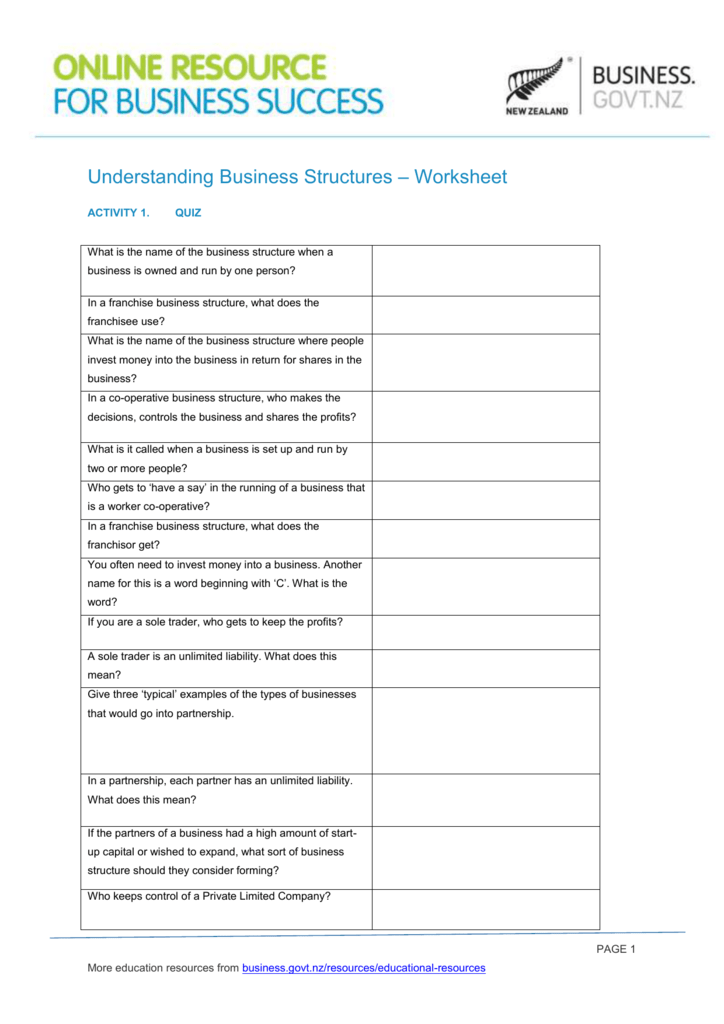

Understanding Business Structures Worksheet

Qualified Lead Definition Tool A Worksheet To Help Sales Marketing Departments Align On Their Definition O Public Relations Sales And Marketing Definitions

Avery Com Templates 8371 Business Cards Free Online Business Card Design Temp Business Card Template Design Marketing Business Card Business Card Template Word

Musical Performance Contract Free Printable Documents Contract Template Marketing Plan Template Work For Hire

Challenger Sale The Reframe Exercise Challenger Sale Challenger Exercise

Partnership Agreement Templates Examples Pdf Doc Examples Inside Template For Business Partnership Agreement 10 Prof Contract Template Partnership Agreement

Sample Printable Notice Of Intent To Exercise Option Form Real Estate Forms Word Template Intentions

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Solved Exercise 12 8 Sale Of Partnership Interest Lo P3 The Chegg Com

Rev 999 Partner S Outside Tax Basis In A Partnership Worksheet Free Download

Limited Partnership Contract Template Contract Template Limited Liability Partnership Partnership

Partnership Agreement Templates 16 Free Word Pdf Samples Job Resume Template General Partnership Statement Template

Free Printable Partnership Agreement Legal Forms Contract Template Partnership Legal Forms

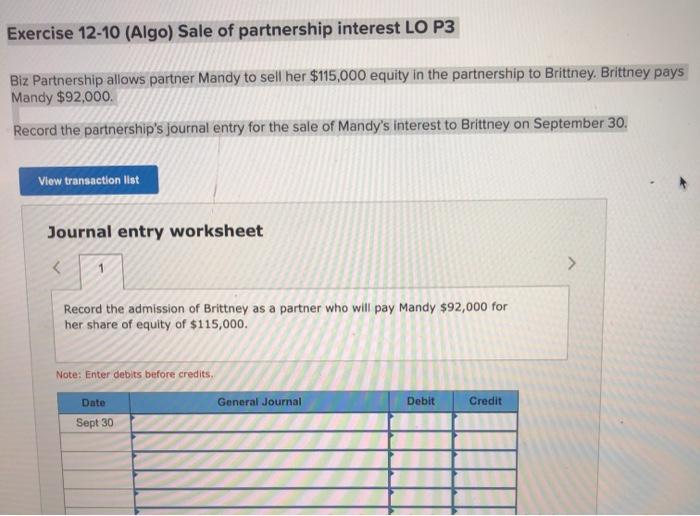

Solved Exercise 12 10 Algo Sale Of Partnership Interest Lo Chegg Com

Business Partnership Agreement Template Email Template Business Email Template Examples Business Resume Template

Ms Excel Mortgage Qualification Worksheet Template Excel Templates Worksheet Template Excel Templates Worksheets

Solved Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Tidak ada komentar:

Posting Komentar